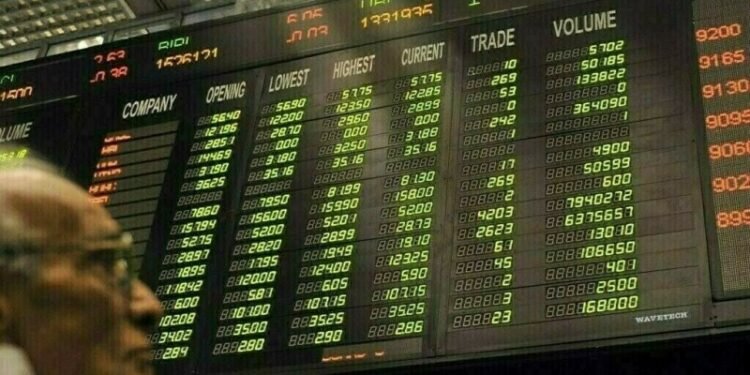

The Pakistan Stock Exchange (PSX) ended another trading session on a flat note, while both the value and volume of shares traded declined on a day-to-day basis .

During the session on Thursday, the market swung both ways as the benchmark KSE-100 plunged to an intra-day low of 65,187.69.

However, the market trimmed its losses during the final hour of buying and the KSE-100 settled at 65,603.09 level, still down 53.53 points or 0.08%.

A mixed trend was witnessed during the day, however, index-heavy energy stocks of OGDC, PPL, PSO and SHEL settled in the green.

“Investors refrained from making big moves as concerns over a weakening rupee and escalating external debt compounded by uncertainties surrounding new International Monetary Fund (IMF) conditions rattled confidence,” said Capital Stake, a brokerage house, in a report.

On Wednesday, Pakistan stocks surrendered their earlier gains amid final-hour profit-taking as the benchmark KSE-100 index settled at 65,656.62, an overall decrease of 69.42 points or 0.11%.

Internationally, Asian shares rose on Thursday while the dollar nursed losses after the world’s most powerful central banker reassured investors that US rates would fall this year, setting the scene for policymakers in Europe.

Japan’s Nikkei, however, reversed earlier gains and the yen jumped past the 149 per dollar level to the highest in a month as momentum builds that a move from the Bank of Japan to end negative interest rates could come as soon as this month.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.4%, while Japan’s Nikkei slid 0.9%, after hitting a fresh all-time high earlier in the session.

Meanwhile, the Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Thursday. At close, the local unit settled at 279.29, a gain of Re0.06, against the greenback, as per the State Bank of Pakistan.

Volume on the all-share index decreased to 354.15 million from 419.74 million a session ago.

The value of shares dropped to Rs14.4 billion from Rs18.3 billion in the previous session.

Pakistan Rupee Exchange Rate

Pakistan Rupee Exchange Rate