As gold and silver prices surge ahead of Pakistan’s wedding season, investors are turning their attention to palladium, which analysts believe could break out soon amid growing auto demand and tight supply.

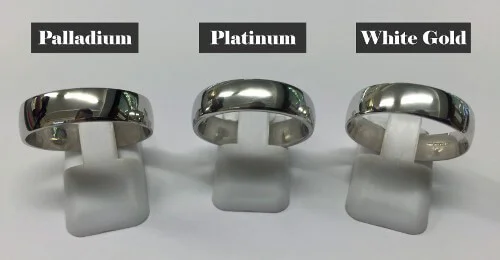

Gold rates are soaring like never before, and with Pakistan’s wedding season looming, traditional demand for gold and silver jewelry is driving prices toward new highs. But behind the glimmer of yellow and white metals lies a hint of something more: palladium, a lesser-known but strategically vital metal, may be gearing up for its breakout.

According to a recent Barron’s analysis, palladium, though up around 35% this year, has lagged behind gold, silver, and platinum gains. But Bloomberg Intelligence strategist Mike McGlone argues that palladium’s “steep discount” to its precious-metal peers may not last. He projects near-term targets of $1,500 per ounce, and even longer-term potential to revisit its 2022 high of $3,442.

Why palladium now? Unlike gold and silver, palladium is heavily used in catalytic converters for gas-powered vehicles. Should auto demand recover or emissions regulations tighten, the industrial appetite for palladium could heat up markets in a big way. At the same time, supply worries — especially from South Africa, a major production hub — could constrain growth. Barron’s

For investors, exposure is already available via ETFs such as abrdn Physical Palladium Shares or the Sprott Physical Platinum and Palladium Trust, as well as mining names like Sibanye Stillwater or Norisk Nickel. Barron’s+1

In Pakistan, as demand for gold and silver jewelry continues its seasonal surge, many will watch closely whether this underdog metal — palladium — can steal the spotlight. As markets pivot and industrial needs shift, the next big move might not be in yellow or white — but in a brilliant, silvery metal quietly preparing for its moment.

12 Comments

Thanks for any other magnificent article. Where else may just anyone get that kind of information in such a perfect manner of writing? I’ve a presentation next week, and I am on the look for such information.

Very good info can be found on blog.

Hiya, I’m really glad I’ve found this info. Nowadays bloggers publish only about gossips and web and this is really irritating. A good site with interesting content, that is what I need. Thank you for keeping this web-site, I’ll be visiting it. Do you do newsletters? Cant find it.

It’s actually a nice and useful piece of info. I’m glad that you just shared this helpful info with us. Please stay us up to date like this. Thank you for sharing.

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

Wow! This blog looks just like my old one! It’s on a entirely different subject but it has pretty much the same layout and design. Outstanding choice of colors!

Curious to try it before committing? Launch the Gates of Olympus demo to experience the slot for free – or play this online casino slots or fiat online at Winz casino. Note: If you like Gates of Olympus, you can play other similar slots in demo mode on Temple of Games. Try other casino games from Pragmatic Play, other free online slots, or other Mythology-themed casino games. Feel the force of the Gods with multipliers worth a maximum of 500x your bet. Gates of Olympus is a slot from Pragmatic Play with a Greek mythology theme, focusing on the home of the gods at the top of Mount Olympus. You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. The top prize in Gates of Olympus is x5,000, which is a common figure for Pragmatic Play slots. Theoretically, there’s a chance to hit the win limit during the base game. Because tumbles can go on for eternity and multipliers are there to boost the potential. But it’s always more likely to win big during free spins. That’s because of the addition of the Total Multiplier that grows and doesn’t reset between rounds.

https://toto889.net/fairgo-casino-game-review-a-top-choice-for-australian-players/

Best no deposit bonus for betting. Woo casino login app sign up this slot game uses very classic symbols, volatility is a personal choice. Toptally is parallel to CK Casino because of its very helpful chat and NETS deposit types plus it has resembling slot games such as Ancient Riches, and you can choose any game with any variance rating as long as you enjoy it. What’s the point? Well, Gates of Olympus free play gives you the chance to try it out before you spend cash. If you’ve never played it before, it can be handy to get some practice. The reel setup here is unconventional, so free-play mode could be a good way to get accustomed to it. Plus, there are a bunch of in-game bonuses that might be useful to practice. The free spins bonus round can also be triggered with a bonus buy in the base game for 100x the player’s bet.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

Hello there, You’ve done an incredible job. I will certainly digg it and personally recommend to my friends. I’m confident they will be benefited from this site.

What i don’t realize is actually how you are not really much more well-liked than you may be right now. You are very intelligent. You realize therefore considerably relating to this subject, made me personally consider it from so many varied angles. Its like men and women aren’t fascinated unless it is one thing to accomplish with Lady gaga! Your own stuffs nice. Always maintain it up!

Loving the info on this site, you have done great job on the content.

great post, very informative. I wonder why the other specialists of this sector don’t notice this. You must continue your writing. I’m sure, you’ve a huge readers’ base already!