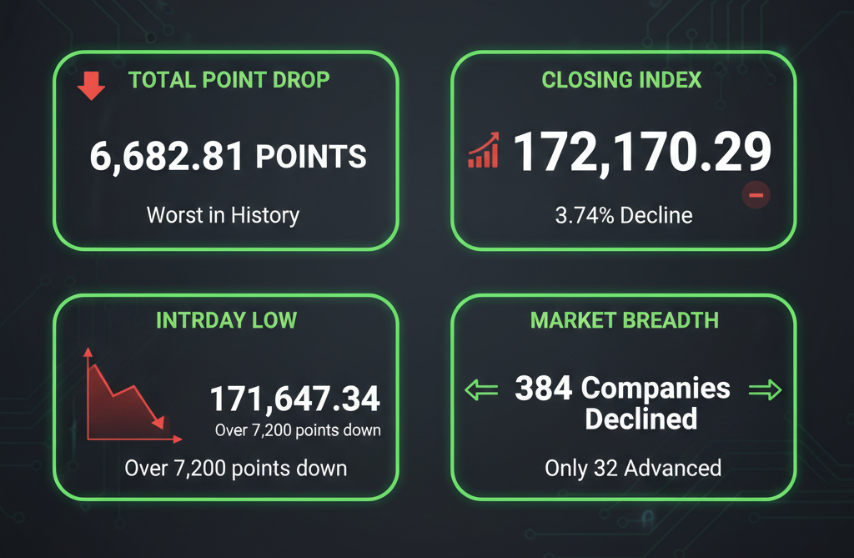

KARACHI — In what financial analysts are calling a “Dark Thursday,” the Pakistan Stock Exchange (PSX) witnessed its most severe single-day point decline in history today, February 19, 2026. The benchmark KSE-100 Index plummeted by a staggering 6,682.81 points, wiping out billions in market capitalization and sending shockwaves through the investment community.

The market nosedived almost immediately after the opening bell, closing at 172,170.29 points—a massive negative change of 3.74%.

1. Market Statistics: The Crash in Numbers

The scale of today’s sell-off is unprecedented. Below is a breakdown of the session’s performance:

The scale of today’s sell-off is unprecedented. Below is a breakdown of the session’s performance:

| Metric | Details |

| Total Point Drop | 6,682.81 points (Worst in history) |

| Closing Index | 172,170.29 |

| Intraday Low | 171,647.34 (Down over 7,200 points at its lowest) |

| Market Breadth | 384 companies declined |

| Market Capitalization | Decreased to Rs 19.514 trillion |

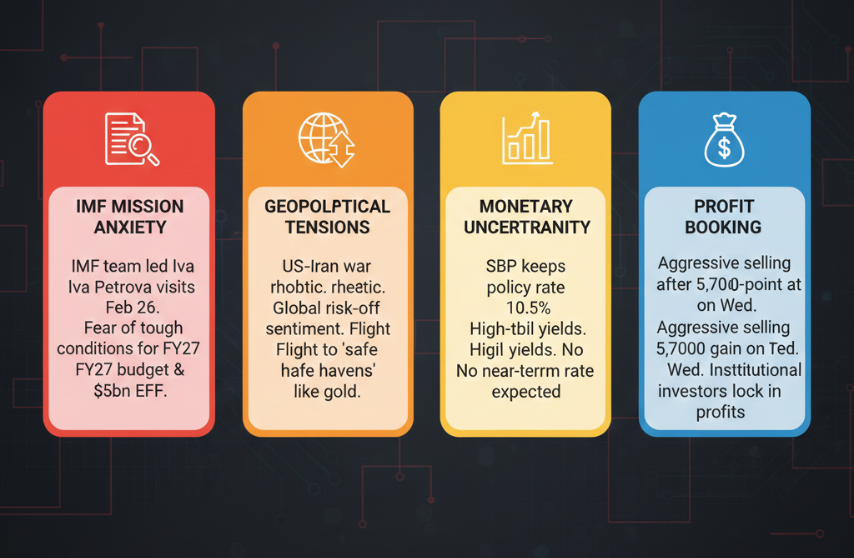

2. Primary Triggers: Why Did the Market Collapse?

Market experts point to a “perfect storm” of domestic and international pressures that fueled the panic:

Market experts point to a “perfect storm” of domestic and international pressures that fueled the panic:

-

IMF Mission Anxiety: An IMF team, led by Iva Petrova, is scheduled to visit Pakistan on February 26. Investors are reportedly spooked by the tough conditions expected for the upcoming FY 2026-27 budget and the progress of the $7 billion EFF program.

-

Geopolitical Tensions: Rising military rhetoric between the U.S. and Iran has dented global risk appetite. This has caused a flight to “safe havens” like gold, as seen in simultaneous crashes across regional markets.

-

Monetary Policy Stagnation: The State Bank of Pakistan’s (SBP) recent decision to keep the policy rate at 10.5%—coupled with rising T-bill yields—has dampened hopes for a near-term rate cut.

-

Aggressive Profit Booking: After a strong 5,700-point gain on Wednesday, institutional investors moved quickly to lock in profits, which accelerated the downward spiral once the panic set in.

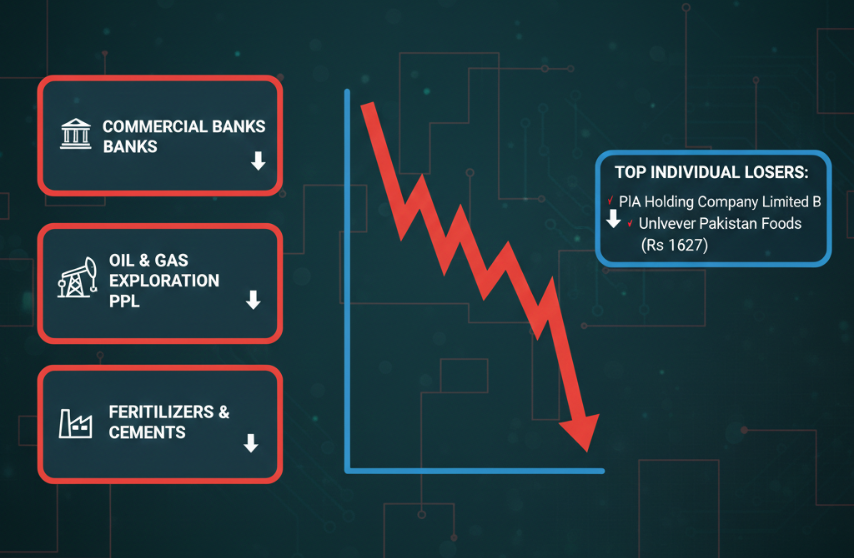

3. Most Impacted Stocks

The crash was broad-based, with heavyweights leading the decline:

The crash was broad-based, with heavyweights leading the decline:

-

PIA Holding Company Limited B: Saw a massive drop of Rs 1,758.34.

-

Unilever Pakistan Foods: Declined by Rs 627.21.

-

High-Volume Laggards: WorldCall Telecom and K-Electric led the volume chart as investors rushed to exit positions.

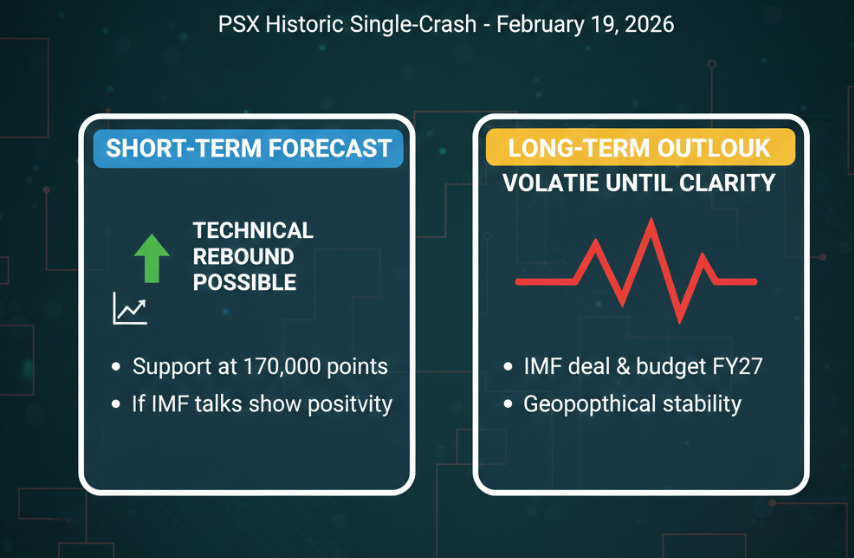

4. Expert Outlook: What’s Next?

While the absolute point drop is the largest on record, some analysts suggest that the market remains in a consolidation range.

While the absolute point drop is the largest on record, some analysts suggest that the market remains in a consolidation range.

“This is a sentiment-driven panic. While 180,000 was a key support level that was breached today, the 170,000 level now stands as the next major psychological floor. A technical rebound is possible if the IMF talks show early signs of positivity,” stated a senior market strategist.

Frequently Asked Questions

1. What caused the PSX crash on February 19, 2026?

The crash was triggered by IMF-related uncertainty, geopolitical tensions, high interest rates, and aggressive profit booking.

2. How much did the KSE-100 Index fall?

The KSE-100 Index dropped by 6,682.81 points, closing at 172,170.29.

3. Was this the biggest crash in PSX history?

Yes, it was the largest single-day point decline in the history of the Pakistan Stock Exchange.

4. Which stocks were most affected?

PIA Holding Company Limited B, Unilever Pakistan Foods, WorldCall Telecom, and K-Electric saw major declines.

5. What is the next support level for the market?

Analysts suggest 170,000 is the next major psychological support level.