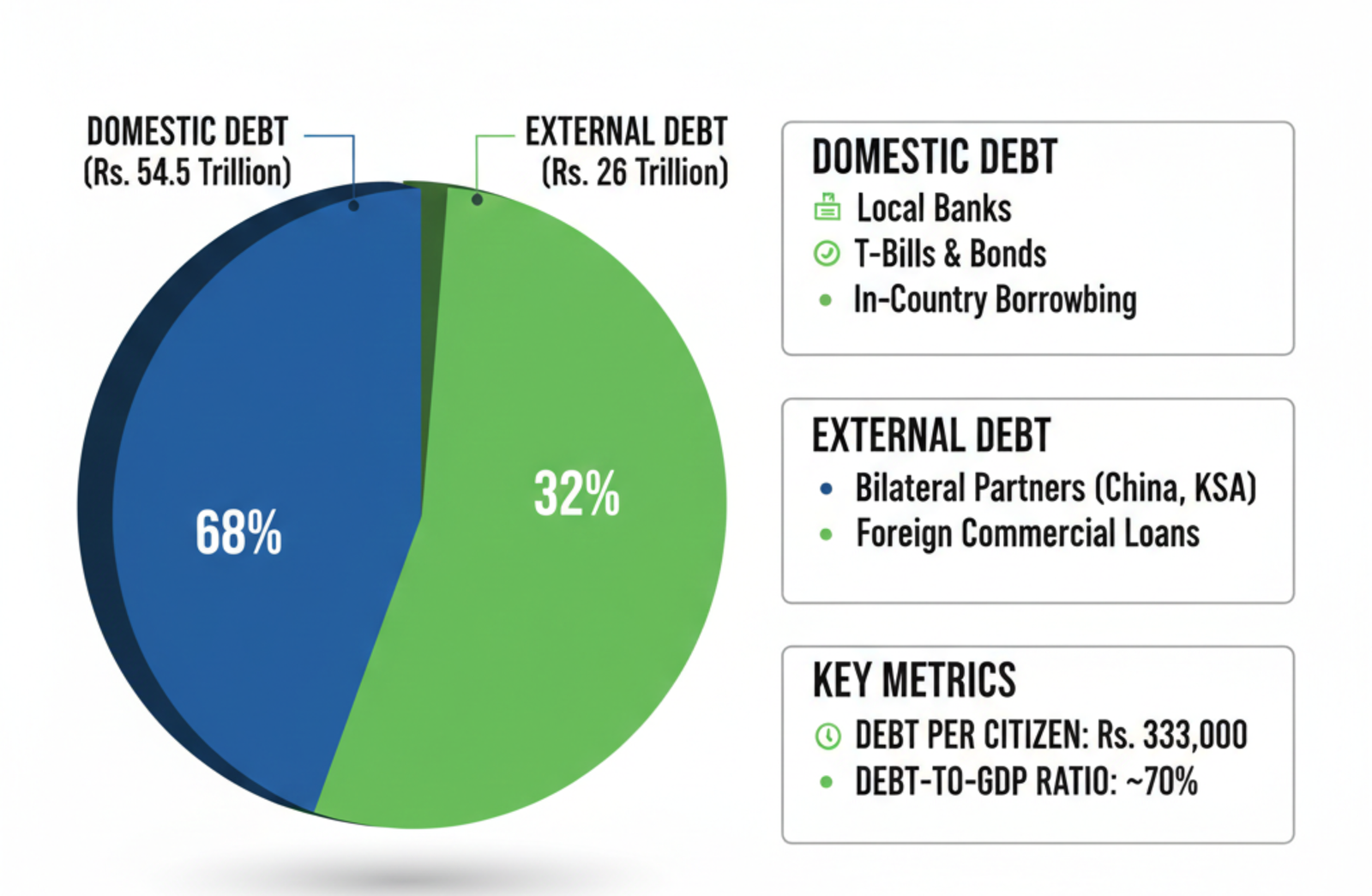

As of early 2026, Pakistan’s economic landscape faces a daunting reality. Recent figures indicate that the country’s total public debt has hit a massive Rs. 80.5 trillion. When distributed across the nation’s population of approximately 242 million people, this translates to a staggering Rs. 333,000 debt for every single Pakistani citizen including newborns.

The Breakdown: Where is the Money?

The debt is divided into two main categories: domestic and external. While the government has made efforts in early 2026 to retire some high-interest domestic debt, the sheer volume remains high.

The debt is divided into two main categories: domestic and external. While the government has made efforts in early 2026 to retire some high-interest domestic debt, the sheer volume remains high.

-

Domestic Debt (approx. 68%): Borrowed from local banks and institutions through treasury bills and bonds.

-

External Debt (approx. 32%): Owed to international lenders like the IMF, World Bank, and bilateral partners such as China and Saudi Arabia.

| Metric | Amount |

| Total Public Debt | Rs. 80.5 Trillion |

| Debt Per Citizen | Rs. 333,000 |

| Debt-to-GDP Ratio | ~70% |

Why has the Debt Grown?

Several factors have contributed to this record-breaking number over the last few years:

Several factors have contributed to this record-breaking number over the last few years:

-

Fiscal Deficits: The government continues to spend more than it earns in tax revenue, necessitating further borrowing to bridge the gap.

-

Interest Payments: A significant portion of the national budget is now consumed simply by paying the interest on existing loans, often referred to as “debt servicing.”

-

Currency Fluctuations: As the PKR has faced volatility against the US Dollar, the cost of repaying external loans has naturally increased.

A Decisive Shift? Recent Early Repayments

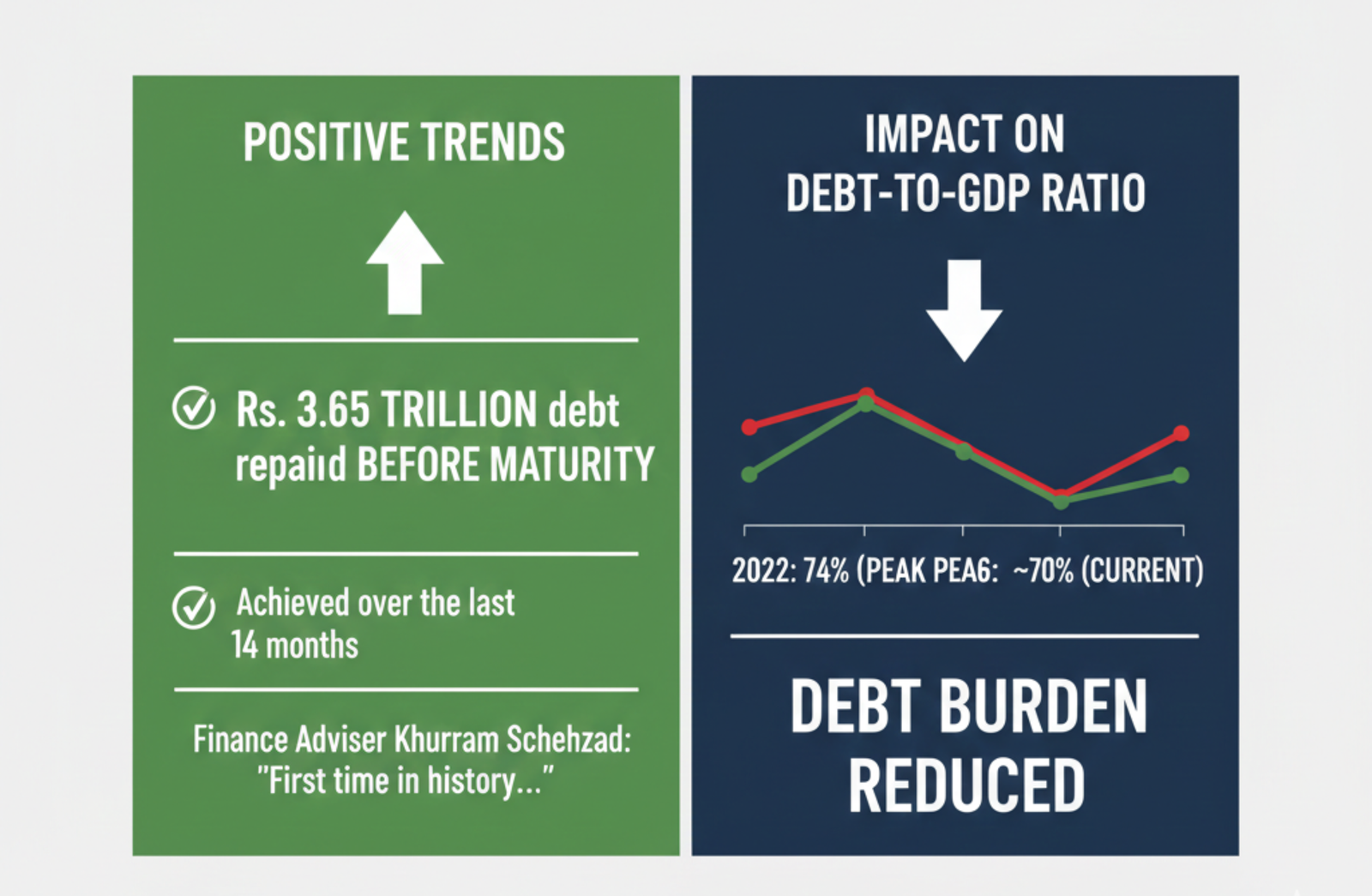

Despite the high total, there is a glimmer of a “shift” in early 2026. Finance Adviser Khurram Schehzad recently noted that Pakistan has begun early debt retirement.

Despite the high total, there is a glimmer of a “shift” in early 2026. Finance Adviser Khurram Schehzad recently noted that Pakistan has begun early debt retirement.

This proactive management has helped the debt-to-GDP ratio drop from a peak of 74% in 2022 to roughly 70% today, suggesting that while the total number is high, the economy’s capacity to handle it is slowly improving.

What Does This Mean for the Average Citizen?

For the common man, a high national debt often manifests as:

-

Inflation: Borrowing often leads to a devalued currency and higher prices for fuel, electricity, and food.

-

Reduced Development: More money spent on interest means less money available for hospitals, schools, and infrastructure.

-

Tax Burden: To repay these loans, the government is often forced to increase taxes on the salaried class and businesses.

The Path Forward

Economists argue that the only way to reduce this “per-head debt” is through consistent Primary Surpluses (earning more than spending before interest) and aggressive privatization. While the current early repayments are a positive sign of fiscal discipline, the road to bringing that Rs. 333,000 figure down remains long.

Frequently Asked Questions (FAQs)

1. How is the Rs 333,000 per person figure calculated?

This figure is derived by dividing the total public debt of Rs 80.5 trillion by Pakistan’s estimated population of 242 million. It represents the theoretical share of the national burden carried by every man, woman, and child in the country.

2. Is Pakistan currently repaying its debt?

Yes. As of late January 2026, the government has achieved a “decisive shift” by retiring over Rs 3.65 trillion in domestic debt before its maturity date. This proactive management has helped lower the debt-to-GDP ratio from 74% to approximately 70%.

3. What is the difference between domestic and external debt?

-

Domestic Debt (~Rs 54.5 trillion):

Money borrowed from within the country (local banks, T-bills, and Sukuks). -

External Debt (~Rs 26 trillion):

Money owed to international lenders like the IMF, World Bank, and foreign countries (China, Saudi Arabia, etc.).

4. Why does the debt keep increasing if we are repaying it?

While the government is retiring old debt, it still faces a fiscal deficit meaning it spends more on essential services, defense, and subsidies than it collects in taxes. To bridge this gap, new loans are often taken, though the rate of growth has slowed significantly in 2025-26.

5. How does this national debt affect my daily life?

High national debt leads to inflation (rising prices), higher taxes to cover interest payments, and less government spending on public sectors like healthcare, education, and infrastructure.